Logistics

The market for logistics property has seen marked change in recent years. A pandemic, bottleneck effects and geopolitical unrest have laid bare the vulnerabilities in global supply chains and elevated warehousing demand in a bid for predictability. Uncertain times combined with high demand for goods have opened a growing number of investors’ eyes to warehousing and logistics property.

Supply chain resilience

In the past six months the war in Ukraine and new lockdowns in China have yet again shone a light on the delivery problems in the global supply chains, and several logistics firms have switched their supply chain strategies in an attempt to mitigate challenges in the value chain. Firms are now looking to stock greater volumes of raw materials throughout the value chain and more of their finished goods closer to the end users. One direct consequence of this risk aversion is a growing demand for warehousing space. More information about the freight crisis and its impact on logistics property can be found in the August edition of our monthly analysis product Market Views.

5 Logistics

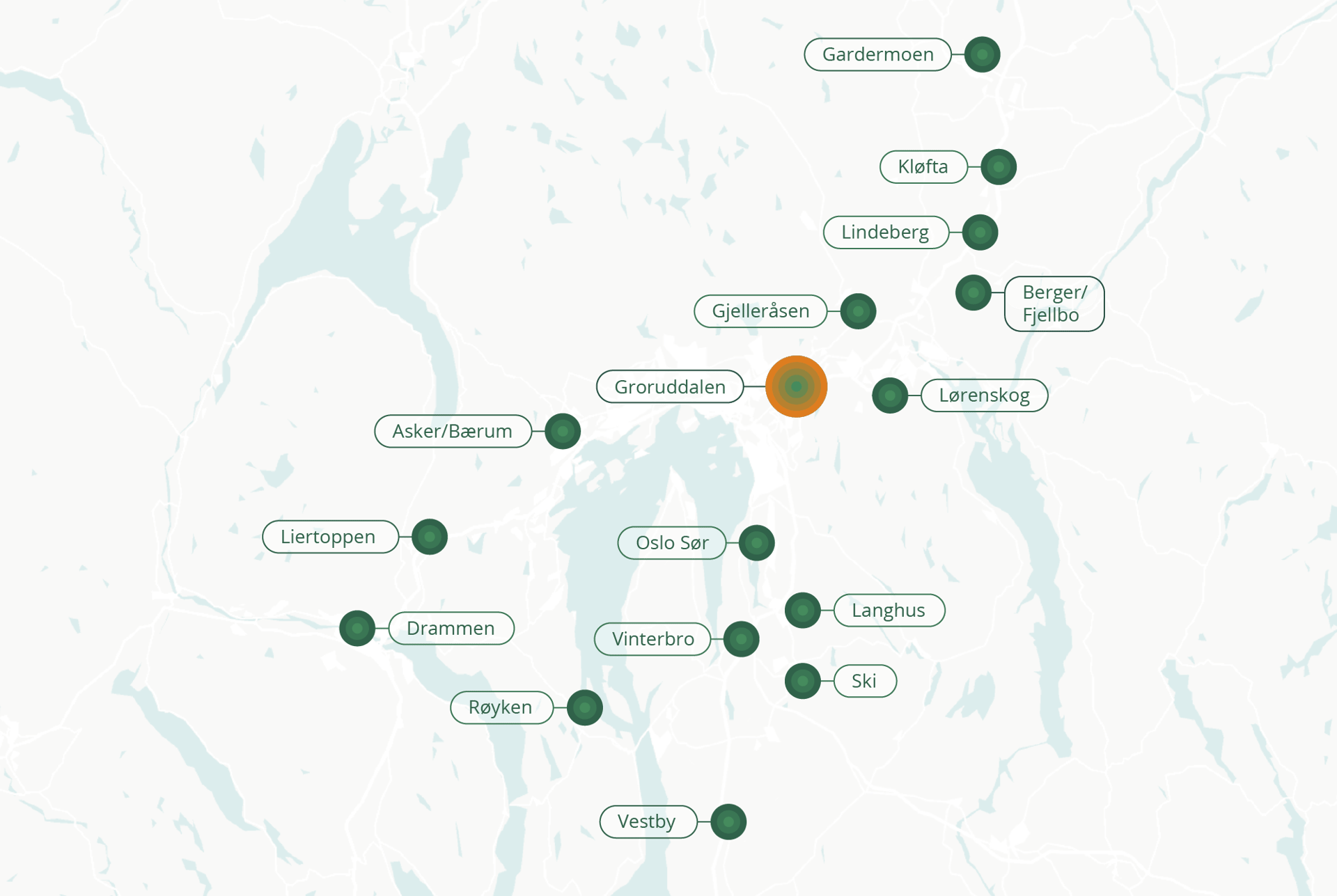

Rental price range in various logistics areas.

Click on the areas to see the rental price range (NOK / sq m)

Groruddalen

1 600 – 2 200

Gardermoen

900 – 1 100

Gjelleråsen

1 000 – 1 300

Asker/Bærum

900 – 1 300

Liertoppen

1 000 – 1 400

Vestby

800 - 1 000

Drammen

800 – 1 250

Berger/Fjellbo

1 200 – 1 400

Lørenskog

1 200 – 1 400

Oslo Sør

1 200 – 1 400

Kløfta

1 100 – 1 300

Vinterbro

1 100 - 1 300

Langhus

1 200 – 1 400

Lindeberg

1 200 – 1 400

Ski

1 100 – 1 300

Røyken

700 – 950

Leasing market

High demand for logistics property has led to considerable pressure on rents. Since the end of 2020, rents for the best logistics properties have risen by more than 23 per cent from NOK 1,300 to NOK 1,600 per square metre. As a result of the expected weakening of household consumption, we believe that most of the rent increases for logistics property have been realised in the short term, but the outlook is good further ahead once household consumption settles back into its rising, long-term trend.

↑ Prime yield

Up 75 bps in Q2 and Q3 2022

45

%

4.

Transaction volume, billion NOK

2022 YTD and

2021

Prime rents, NOK

→ Large warehouses (>6 000 sq m) and

↑ Small warehouses (<6 000 sq m)

450

1

2 000

0

12.

0

31.

Logistics rent, large and small warehouses

Den høye aktivitetsveksten vi har hatt i norsk økonomi inntil nylig har bidratt til et brennhett kontormarked med svært lav arealledighet og uvanlig høy leieprisvekst. Selv om etterspørselen etter kontorareal skulle kjøle seg ned framover, antar vi at arealledigheten vil bli holdt nede av historisk lav tilførsel av nytt areal. Sammen med høy vekst i KPI, venter vi at lav arealledighet vil bidra til å støtte oppunder veksten i kontorleie til neste år.

Consumers are being increasingly demanding when it comes to the online shopping experience, and there is a growing need for swift and environmentally friendly delivery. This is borne out by the demand for centrally located warehouses which can be used for last-mile distribution. A significant number of such premises have been repurposed in recent years, primarily into homes. Recently we have also seen atypical logistics tenants renting traditional warehouse spaces in central locations but using them for other purposes. Examples include electric car retailers in need of fulfilment centres and garages, as well as unmanned shops/warehouses.

Logistics prime yield, percent

Outlook