Logistics

As with other segments, logistics is affected by the economic headwinds. The strong momentum seen during the pandemic has ebbed away. Yet the market fundamentals remain robust, with low vacancy rates in the most attractive areas, healthy demand, and strong rent increases.

Transaction market

A significant worsening in financing terms last year resulted in a sharp drop in logistics transaction volumes from the 2021 peak. In the past 12 months we have seen sales of industrial and logistics property of NOK 14.7 billion, of which NOK 1.4 billion has been recorded in 2023. There have been few reference transactions in the market to give an idea of yields and prices.

As of mid-April the prime yield for logistics is 4.75 per cent, with further upward pressure likely in the short term.

5 Logistics

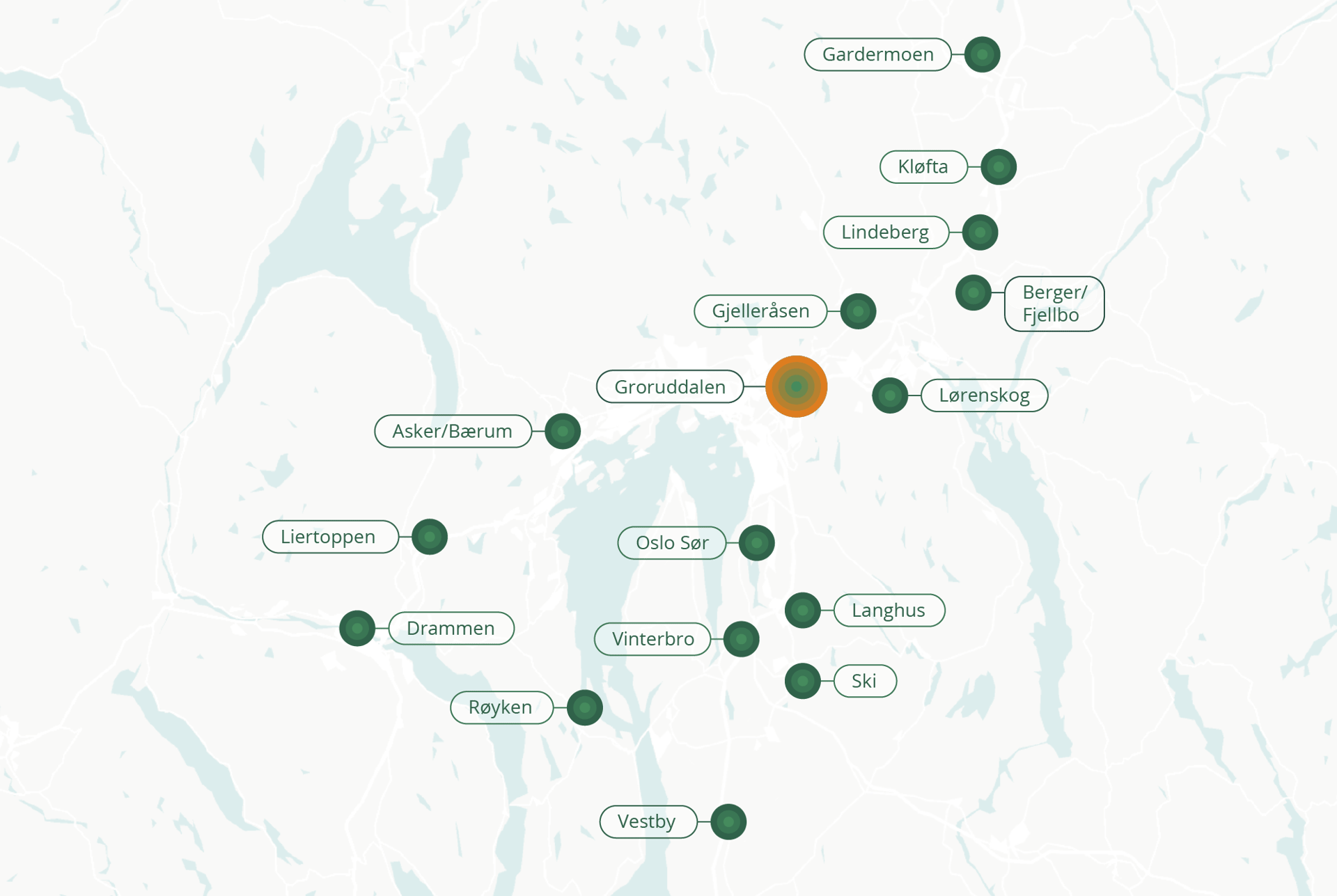

Rental price range in various logistics areas.

Click on the areas to see the rental price range (NOK / sq m).

Groruddalen

1 700 – 2 200

Gardermoen

1 000 – 1 200

Gjelleråsen

1 100 – 1 400

Asker/Bærum

1 000 – 1 400

Liertoppen

1 050 – 1 450

Vestby

900 - 1 100

Drammen

850 – 1 300

Berger/Fjellbo

1 350 – 1 550

Lørenskog

1 300 – 1 500

Oslo Sør

1 300 – 1 500

Kløfta

1 200 – 1 400

Vinterbro

1 150 - 1 350

Langhus

1 350 – 1 550

Lindeberg

1 300 – 1 500

Ski

1 200 – 1 400

Røyken

900 – 1 100

Robust rent rises

The most attractive logistics hubs around Oslo are seeing low vacancy rates, and demand for vacant premises remains high. A steep increase in construction costs has boosted rents in the past couple of years, with rents for large warehouses rising by 30 per cent between Q4 2020 and Q2 2023. The top rent for warehouses larger than 6,000 sqm. is now NOK 1,700 per sqm.

↑ Prime yield

Up 75 bp in Q3 2022

45

%

4.

Transaction volume, billion NOK

2023 YTD and

2022

Prime rent, NOK

↑ Large warehouses (>6,000 sqm) and

↑ Small warehouses (<6,000 sqm)

0

16.

560

1

2

75

0

1.

Logistics rent, large and small warehouses

Den høye aktivitetsveksten vi har hatt i norsk økonomi inntil nylig har bidratt til et brennhett kontormarked med svært lav arealledighet og uvanlig høy leieprisvekst. Selv om etterspørselen etter kontorareal skulle kjøle seg ned framover, antar vi at arealledigheten vil bli holdt nede av historisk lav tilførsel av nytt areal. Sammen med høy vekst i KPI, venter vi at lav arealledighet vil bidra til å støtte oppunder veksten i kontorleie til neste år.

The smaller, centrally located warehouses have achieved even bigger rent increases. The supply side is constrained as a a significant volume of premises have been converted into residential use in recent years. New businesses, such as dark stores, last-mile logistic distributors and electrical car manufacturers, with different objectives than traditional warehouse operators, have begun to show interest and a much greater willingness to pay, which has pushed up rents for the best premises. Top rents in this segment have increased by as much as 60 per cent from NOK 1,400 to NOK 2,200 in the past three years. More information about last-mile logistics in the Oslo region can be found in the March edition of our monthly analysis product Market Views.

Logistics prime yield, percent

Outlook