In 2023, sustainability has gained even broader appeal in the real estate market. Ambitious zero-emission buildings are highly relevant, but minimum energy efficiency requirements have prompted a broader group of property stakeholders to focus on environmental impact.

ESG

Several of our neighbouring countries have already implemented energy efficiency requirements, and there is more clarity around the EU's proposed energy efficiency requirements. Energy performance certificates (EPC), therefore, receives significant attention in many transaction processes – more so this year than in previous years.

In a large survey among JLL's brokerage offices in Europe, 82 percent report that investors have refrained from investment opportunities due to environmental aspects of the buildings.

Survey among 57 JLL transaction teams in EMEA: “Have you experienced investors refraining investment opportunities due to ESG factors?”

9 ESG

Green ambitions among property owners in the Norwegian real estate market remain high, even though this year's sustainability survey by Akershus Eiendom indicates a somewhat more measured approach to green investments.

Weaker economic outlook, high interest rates, and high inflation have likely shifted property owners' focus towards streamlining and enhancing their existing portfolios. Backing this, virtually all respondents in the survey state that they have implemented energy efficiency measures in their portfolios over the past 12 months.

In international markets where minimum energy efficiency requirements are already implemented, there is also a clear impact on rental prices and property values. London is one such market. JLL finds a value difference of over 20 percent for environmentally certified office properties compared to those without when adjusting for location, building age, and renovation needs.

In the same analysis, based on 600 property transactions, JLL finds a green rental premium of 11 percent. Increased rent today, along with an expectation of higher future rent and reduced renovation costs, are important drivers for the significant value difference.

62

%

Investors stating that they have increased willingness to pay for the most innovative environmentally friendly buildings

Primary motivating factors for incorporating sustainability into the investment strategy

(average, ranked from 0-5)

However, Oslo has not reached the same level as London. Our two previous sustainability surveys have indicated relatively low demand for green spaces in the rental market so far.

This year, however, 62 percent of property owners state that tenants have a greater focus on green buildings now than 12 months ago.

Investor: “Do tenants have greater focus on green space now than 12 months ago?”

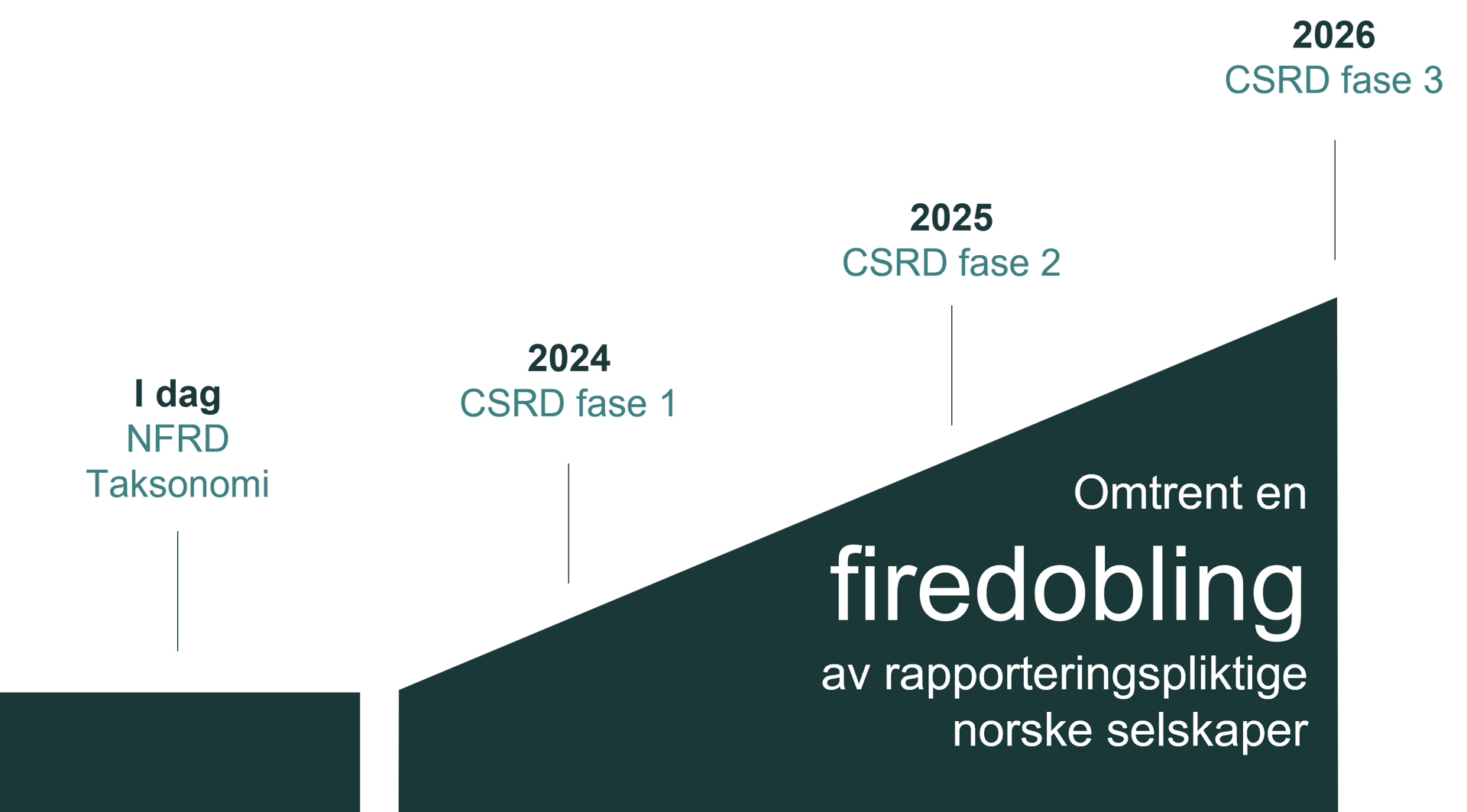

Four times as many companies will be subject to sustainability reporting by 2026

2026

CSRD phase 3

2025

CSRD phase 2

2024

CSRD phase 1

Today

NFRD

Outlook