Logistics

Similar to other segments within commercial real estate, the logistics market is heavily influenced by macroeconomic uncertainty. There is still high activity in the leasing market for logistics properties, and rental prices in attractive logistics hubs continued to rise in 2023.

Transaction Market

In 2023, we recorded a transaction volume of NOK 12 billion in the Norwegian market, representing a decrease of around 30 percent compared to 2022. However, there is still strong demand for logistics properties, and the sector accounted for approximately 20 percent of the total volume in 2023. As of January 2024, we have maintained our prime yield estimate unchanged at 5.75 percent. This represents an increase of 100 basis points since the beginning of the year.

5 Logistics

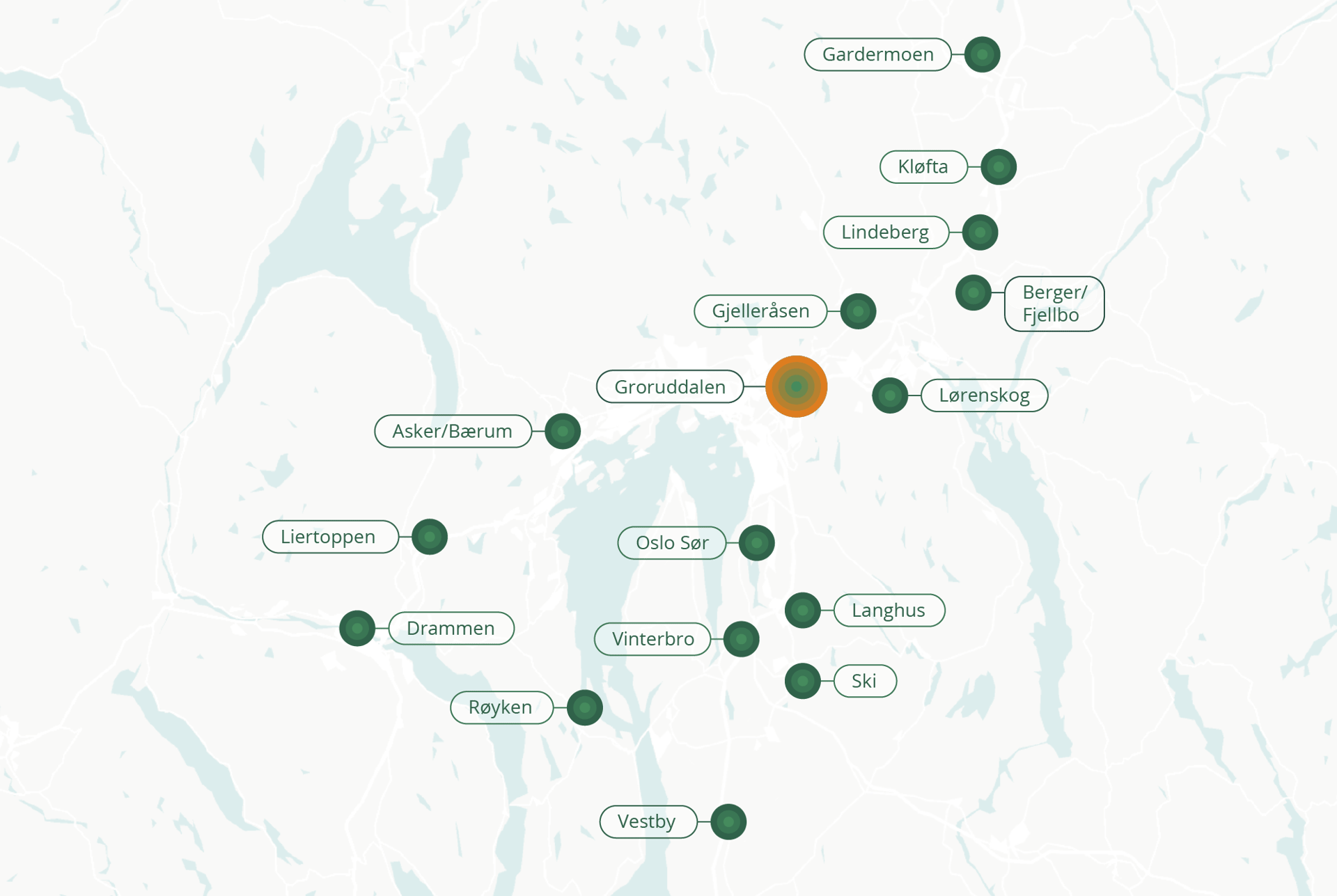

Rental price range in various logistics areas. Click on the areas to see the rental price range (NOK / sq m).

Groruddalen

1 700 – 2 200

Gardermoen

1 100 – 1 300

Gjelleråsen

1 050 – 1 350

Asker/Bærum

950 – 1 350

Liertoppen

1 050 – 1 450

Vestby

1 100 - 1 300

Drammen

850 – 1 300

Berger/Fjellbo

1 450 – 1 650

Lørenskog

1 300 – 1 500

Oslo Sør

1 300 – 1 500

Kløfta

1 300 – 1 500

Vinterbro

1 150 - 1 350

Langhus

1 450 – 1 650

Lindeberg

1 300 – 1 500

Ski

1 200 – 1 400

Røyken

900 – 1 100

Logistics rent, large and small warehouses

Rental Price Growth Slows Down

We continue to experience strong demand for logistics space in several of the establishes logistics hubs around Oslo. Rental prices for large warehouses have increased from NOK 1,600 to NOK 1,700 per square meter, representing a rental growth of approximately 6.5 percent, over the past 12 months. This is mainly explained by a constrained supply side.

For smaller and centrally located warehouses, known as last-mile logistics, rental price growth has been even more impressive. Prices have increased from NOK 2,000 to NOK 2,200 per square meter (10 percent) for smaller, centrally located warehouses during 2023. The expectation of weaker consumer spending in the short term leads us to anticipate a flat rental price development going forward.

→ Prime yield

45

%

5.

Transaction volume, bn NOK

2023 and

2022

Prime rent, NOK

→ Large space (>6 000 sq m) and

→ Small space (<6 000 sq m)

0

0

17.

560

1

2

75

Logistics prime yield, percent

Outlook