Logistics

Significant trends are influencing the logistics market, positioning logistics real estate as one of the strongest property segments in 2024. Demand for logistics space remains high, and combined with a limited supply, this has driven substantial rental price growth in prime areas.

Transactions Market

The logistics segment has undergone significant professionalization over the past decade. Additionally, geopolitical risk and the growing share of e-commerce have increased the segment's attractiveness due to expectations of a stronger rental market. This has led to heightened investor interest in logistics properties, as reflected in the transaction market, where logistics assets are taking an increasingly larger share of the total volume. In 2024, logistics properties account for 28 percent of the total transaction volume. As of August, the prime yield for logistics stands at 5.75 percent, reflecting a stable trend since the last yield increase in Q4 2023.

5 Logistics

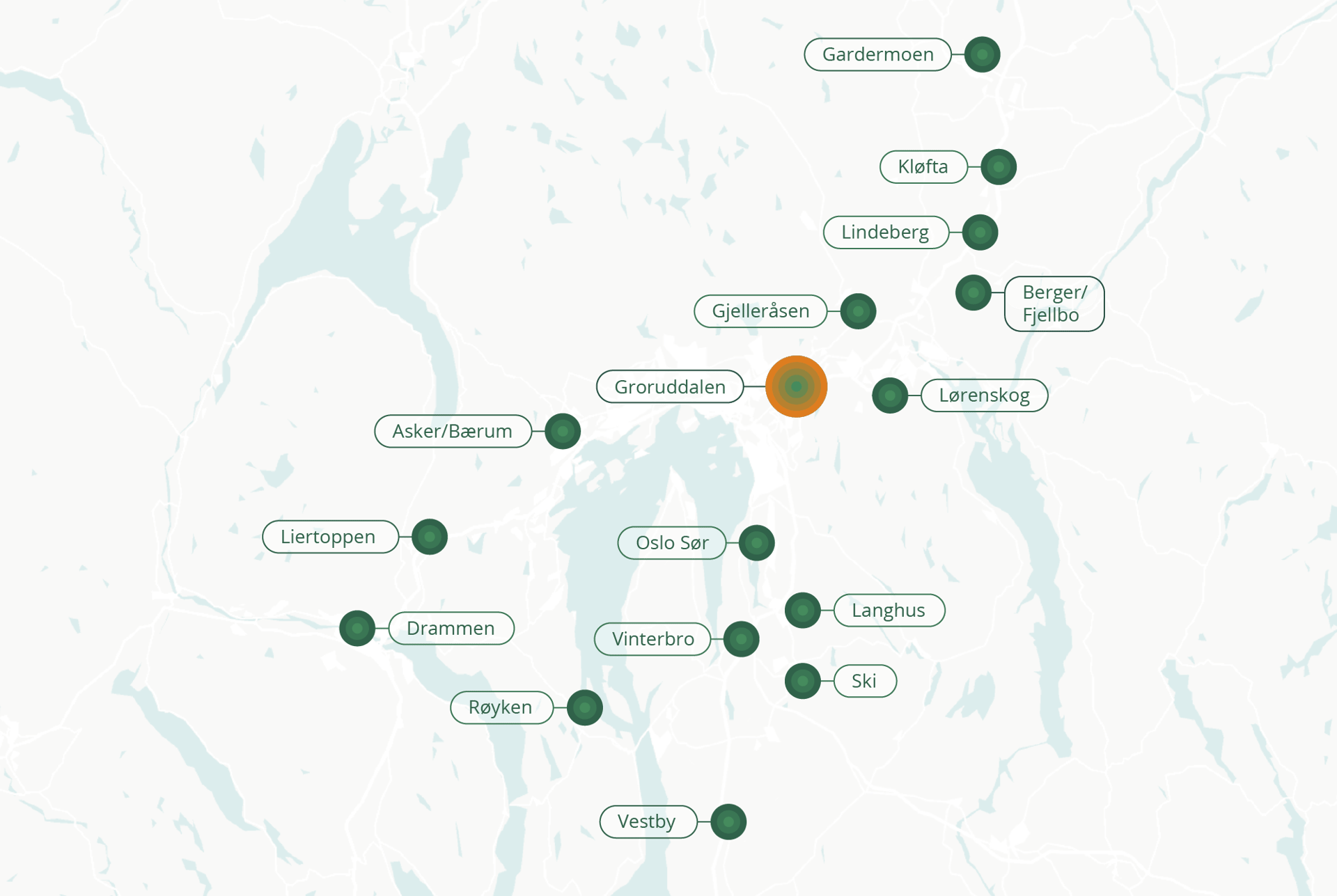

Rental price range in various logistics areas. Click on the areas to see the rental price range (NOK / sq m).

Groruddalen

1 700 – 2 200

Gardermoen

1 100 – 1 300

Gjelleråsen

1 050 – 1 350

Asker/Bærum

950 – 1 350

Liertoppen

1 050 – 1 450

Vestby

1 100 - 1 300

Drammen

850 – 1 300

Berger/Fjellbo

1 500 – 1 700

Lørenskog

1 300 – 1 500

Oslo Sør

1 300 – 1 500

Kløfta

1 300 – 1 500

Vinterbro

1 150 - 1 350

Langhus

1 500 – 1 700

Lindeberg

1 300 – 1 500

Ski

1 200 – 1 400

Røyken

900 – 1 100

Logistics rent, large and small warehouses

Robust Rental Market

Despite challenging market conditions, demand in the rental market has remained robust. In recent years, demand has been driven by changing consumer habits, the growing share of e-commerce, and an increased focus on maintaining inventory availability for consumers (Just-in-Case). Rental rates have leveled off at high levels, with the rental price for large warehouses at NOK 1,700 per square meter. However, some areas have experienced rental price increases, with rates in Berger and Langhus being adjusted to NOK 1,700 per square meter from NOK 1,650 in the first half of 2024. For smaller, centrally located warehouses and last-mile logistics, prices rose to NOK 2,200 per square meter in 2023 and have remained stable since. A weak supply side and consistently high consumption suggest that there may be upward pressure on rental prices in the short term.

Logistics prime yield, percentage

Prime yield

Transaction volumes

Prime rent

5.

70

%

0

.

0

bn

4.

0

bn

2023

2024

NOK

1,

600

NOK

2,

125

Flat development in 2024

Standard (+6,000 sq.m)

Last-mile (<6,000 sq.m)

Key figures

Outlook