Transactions

Chapter 3

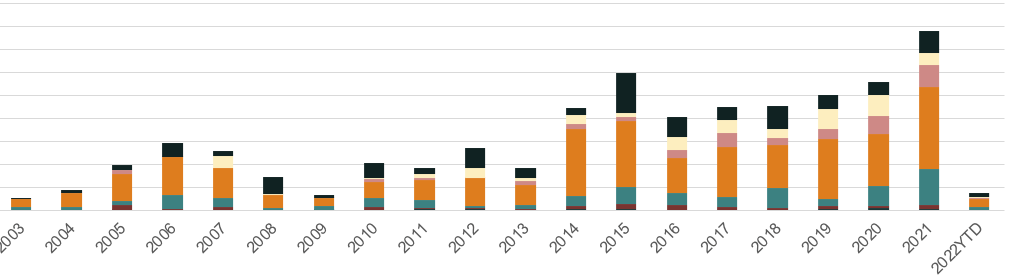

Transaction volumes reached NOK 17.5 billion at the end of the first quarter of 2022. There was an exceptionally strong, record-beating end to 2021, while the start of this year has been somewhat more tentative. Historically speaking, the first quarter is often quieter than the rest of the year, and the consensus is that the limited volume of investment is caused by diminished supply rather than dwindling investor sentiment.

4. Kontor

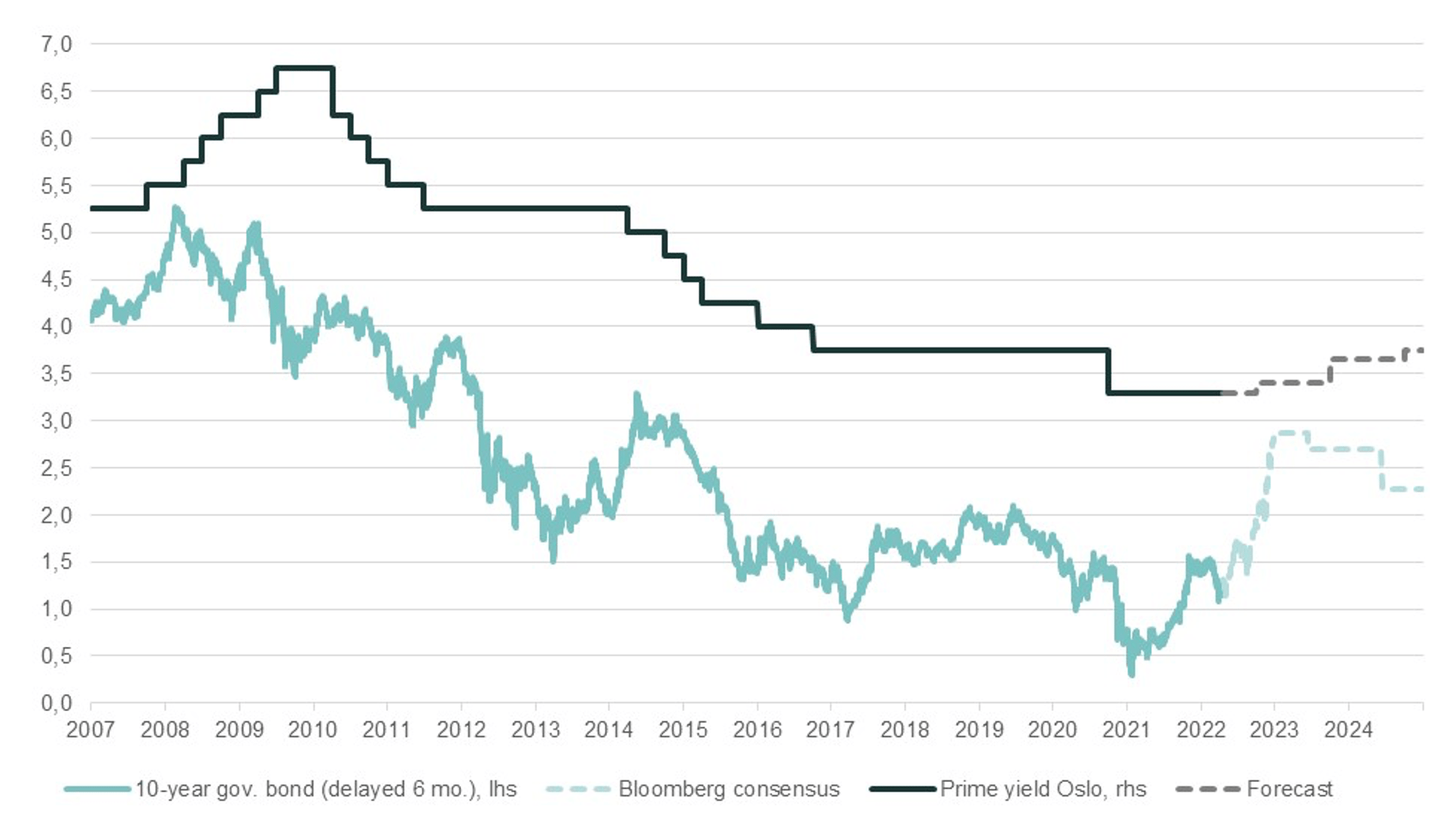

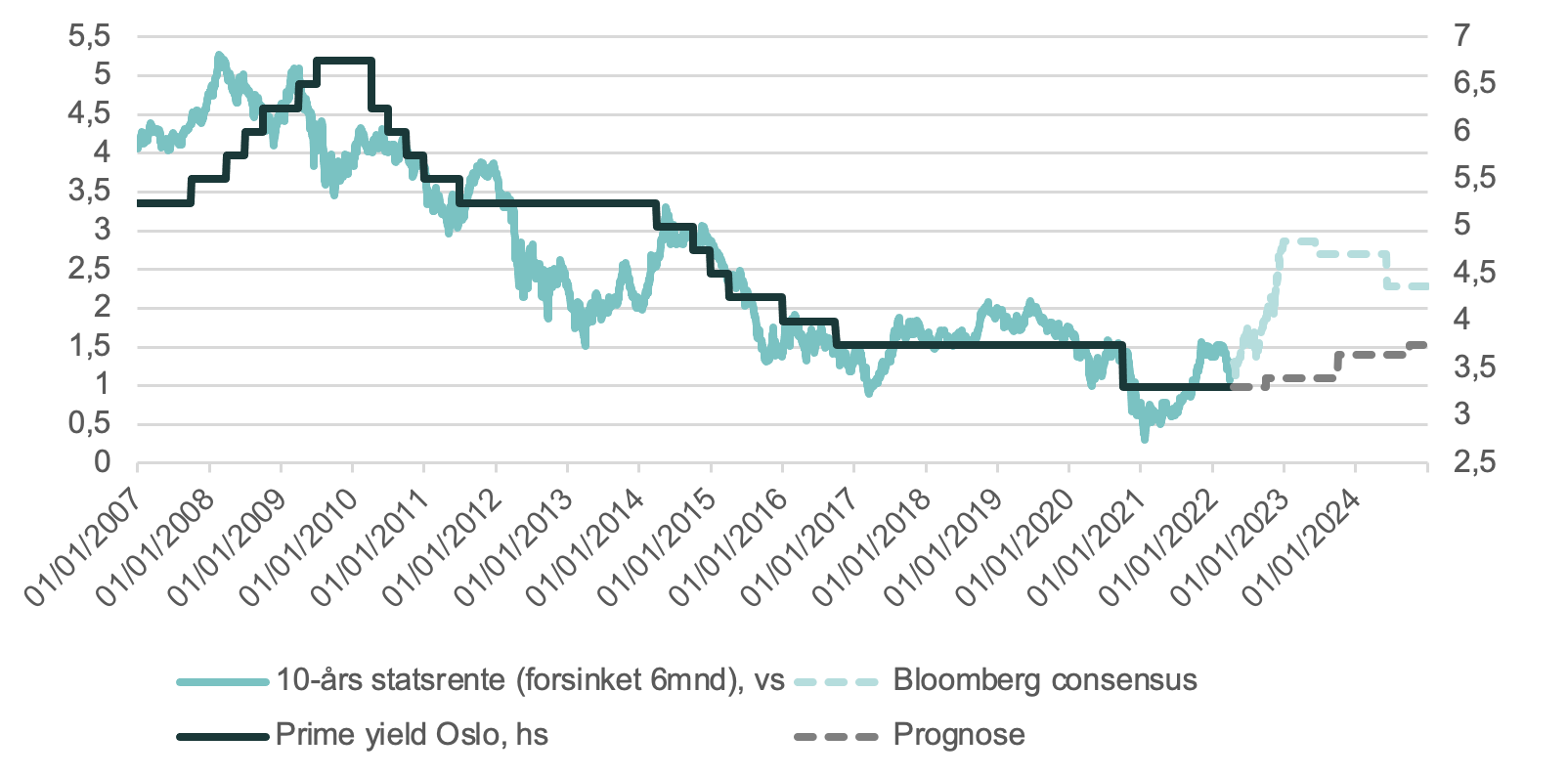

During March and April, the policy rate increased by 0.25 percentage points, while the 5-year swap rate increased by no fewer than 88 basis points to 2.96 percent, yet there have been few indications so far of rising interest rates and higher credit spreads affecting property prices. Most transaction processes are successful, with strong interest and a large number of bidders. The war in Ukraine is obviously attracting much attention, but the impact of the war on the real estate sector is still uncertain.

Increased policy rate, percentage points

0

0.

NB: In Norwegian.

NB: In Norwegian.

Based on the current macro situation and the Norwegian central bank’s interest rate trajectory, we do expect an increase in prime yields going forward – albeit not commensurate with the interest rate rises. Our analyses show increased allocation to property in the capital markets, something which helps safeguard property values despite higher interest rates. Akershus Eiendom therefore predicts changes in prime yield as follows:

2023 (up 35 bps from today)

2022 year end (up 10 bps from today)

0

0

.

%

0

0

.

%

2024 (up 45 bps from today)

0

0

.

%

Transaction volume, NOK million

10-year gov. bond vs Oslo prime yield + forecast, percent

Transaksjonsvolum – vil komme oppdatering på 2022-volumet

Transaksjonsvolum, millioner NOK

Transaksjonsvolum, millioner NOK

10 års statsrente vs Oslo prime yield + prognose

10 års statsrente vs Oslo prime yield + prognose, prosent

10 års statsrente vs Oslo prime yield + prognose, prosent

10 års statsrente vs Oslo prime yield + prognose

10 års statsrente vs Oslo prime yield + prognose

10 års statsrente vs Oslo prime yield + prognose

10 års statsrente vs Oslo prime yield + prognose

10 års statsrente vs Oslo prime yield + prognose – det vil komme en oppdatering på prognosen

There are a number of major uncertainties in the times ahead which make it difficult to estimate a transaction volume for 2022 at this point in time. At the end of April, we are operating with a forecast of NOK 110 billion for this year.