Residential

Chapter 9

We are noting strong demand for residential property in the market, both development land plots and rental properties. The transaction market for rental properties had a record year in 2021, following a trend seen over the past three years. Housing prices have risen sharply during the pandemic as a result of less housebuilding and record-low interest rates. We now expect housing price growth to ease off as a result of increasing interest rates.

y-o-y growth resale property prices

Investor interest in the Norwegian living sector has been growing in recent years and investment in the sector reached record levels in 2021. We are finding that a wider range of buyers are entering this market, and investors are buying into new segments in the living sector. For example, build-to-rent has become more widespread of late. We expect the growing interest in the living sector to continue.

On the other hand, the transaction volume for residential land plots was very low last year following two years of high volumes. This was primarily due to a shortage of large land plots in the market.

Transaction market

0

0

.

%

Norway has a fairly small living sector. The country has a very high rate of home ownership as a result of political planning over many years. Around one million people in Norway currently rent their own home, which is around 18 percent of the population. In Oslo the proportion of renters is much higher at around 27 percent. The rental market has long been dominated by small private landlords, and we believe the living sector is in need of consolidation and professionalisation.

Rental market

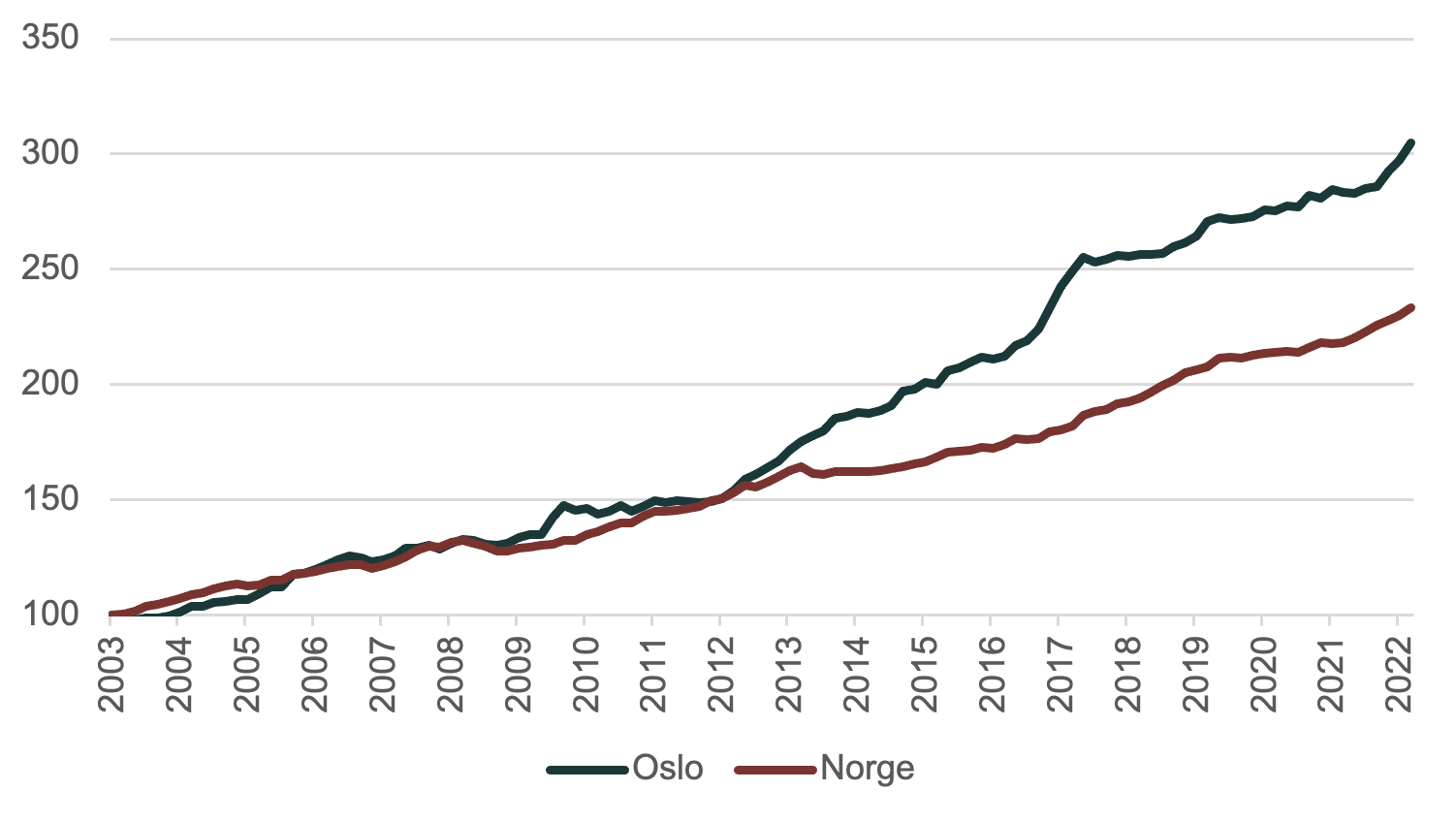

y-o-y growth new-build property prices

0

.0%

NB: In Norwegian.

NB: In Norwegian.

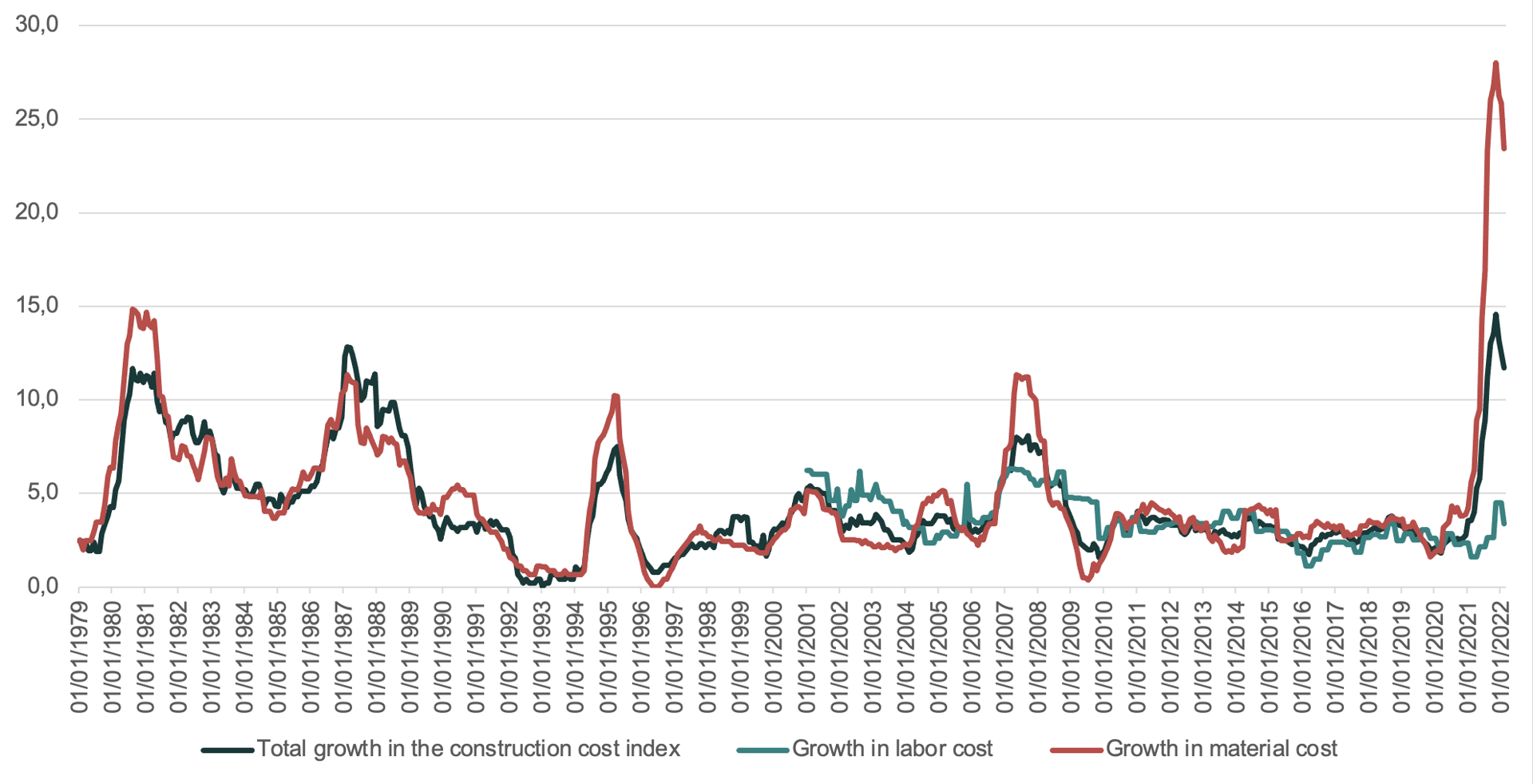

Residential building costs have spiked since the start of the pandemic – and the increase has been reinforced since Russia invaded Ukraine. At the same time, new-build prices in Oslo and the country as a whole have seen moderate growth in recent years.

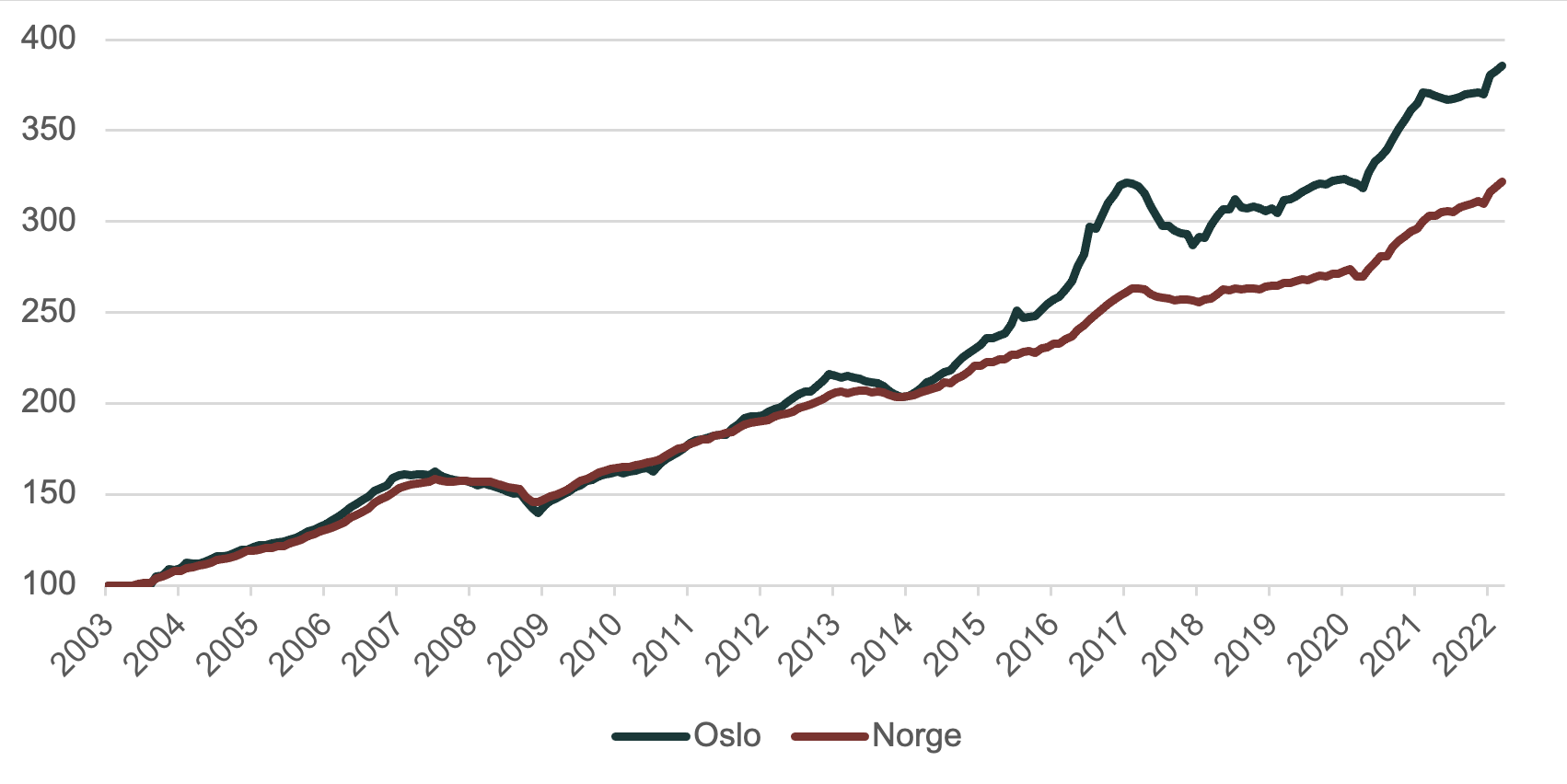

On the other hand, prices for resale property increased by more than 19 percent during the last two years and is up by just under 4 percent so far this year, adjusted for seasonal variations. The sharp price growth is largely due to low interest rates, and in Oslo prices have been pushed up even further by a limited new-build volume relative to population growth for some time. The significant price growth seen so far this year can broadly be attributed to bottlenecks on the supply side as a result of more stringent rules on documentation when selling property.

Housing price development

Price development resale property (seasonal adjusted), indexed

Price development new-build, indexed

Bruktbolig - Sesongjustert

Nybolig

Boligprisutvikling nybolig vs. Bruktbolig – grafen vil oppdateres med et nytt punkt

Boligprisutvikling nybolig vs. Bruktbolig – grafen vil oppdateres med et nytt punkt

Bruktbolig - Sesongjustert

Nybolig

Construction cost index, incl components

Byggekostnadsindeksen, inkl komponenter

Outlook

We now expect housing price growth to ease off as a result of higher interest rates, but still continue to rise.

Despite increasing building costs, we expect demand for residential land plots to remain strong and the trend of increased investor interest in the living sector to continue.